April 2025 Tax Brackets Single. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: Standard deductions for 2025 and 2025 tax.

There are seven federal tax brackets for tax year 2025, and the irs has increased its income limits by about 5.4% in 2025 for each bracket. The average share of corporate tax revenue among the 38 oecd.

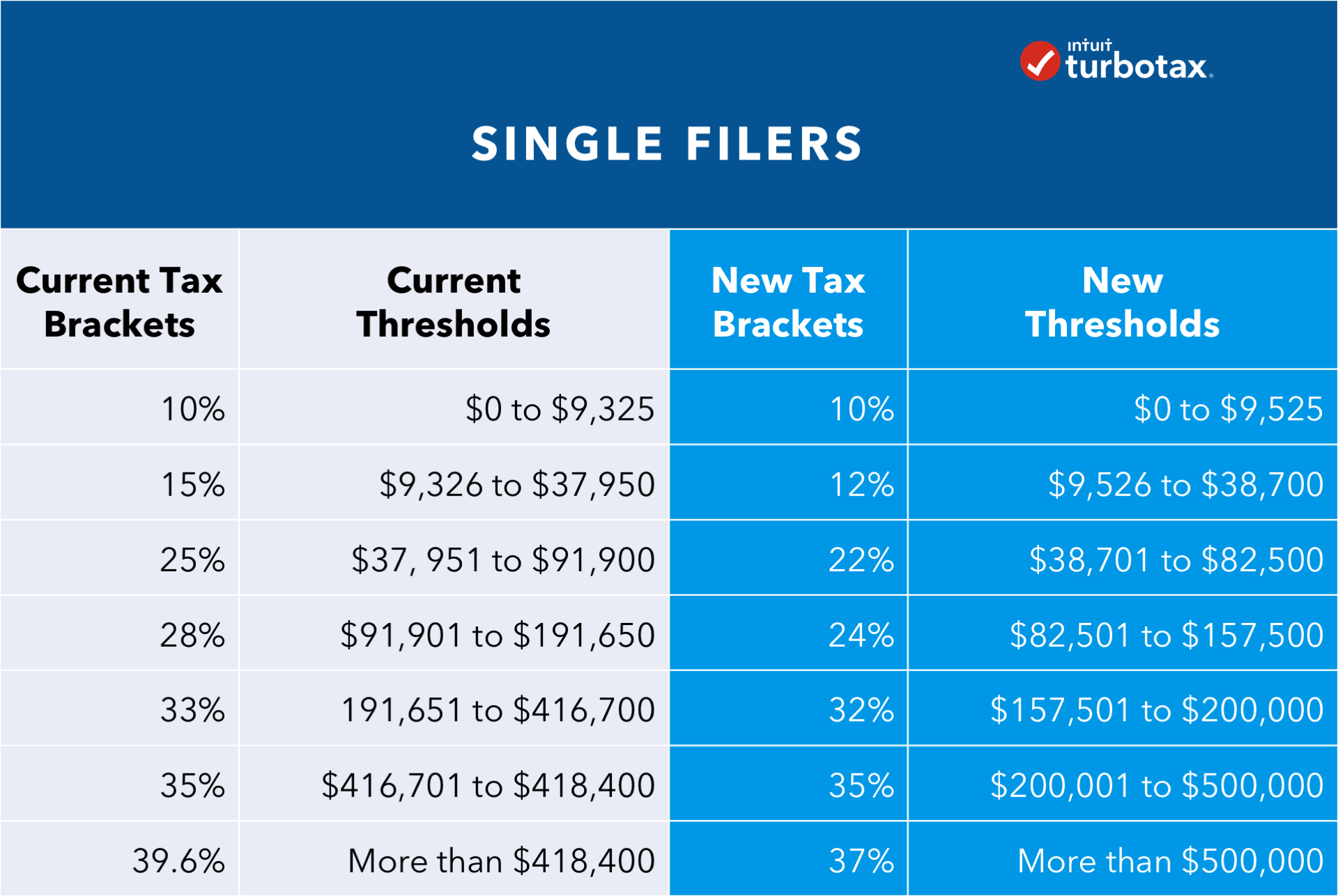

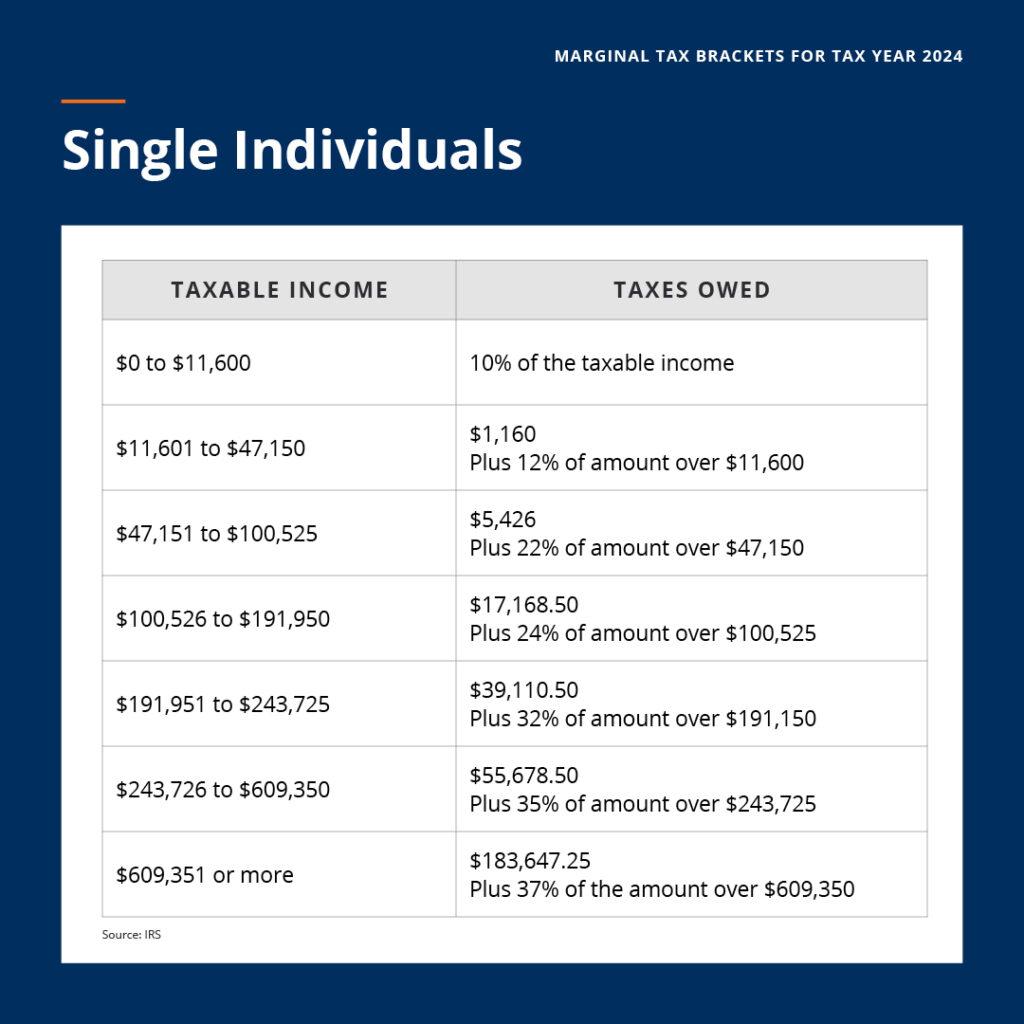

2025 Tax Brackets Single Filer Tool Libby Othilia, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 12% for incomes over $11,600 ($23,200 for married filing jointly) 10% for single individuals earning $11,600 or less ($23,200 for married couples filing jointly) the alternative minimum tax.

Irs New Tax Brackets 2025 Romy Carmina, Contents [ show] the income tax slabs are different under the old and the new tax regimes. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

What is a Tax Bracket? The TurboTax Blog, You can file as single if you are not. Get emails about this page.

2025 Tax Brackets Announced What’s Different?, You'll need the premium paramount plus with showtime plan in order to livestream the march madness games broadcast on cbs. There are seven tax brackets for most ordinary income for the 2025 tax year:

2025 Tax Brackets Chart Vonni Johannah, If you live or work in st. Games on cbs for $12 a month.

Here are the federal tax brackets for 2025, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Let’s say you’re single, and for 2025 your taxable income is $27,050.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the 2025 tax year, for example, the 24 percent tax bracket kicks in on income over $95,375 for single taxpayers and $190,751 for married joint filers, with similar changes in other tax. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Here’s how that works for a single person earning $58,000 per year: 12 march 2025 — see all updates.

IRS Tax Brackets AND Standard Deductions Increased for 2025, Single filers and married couples filing jointly; Federal income tax filing statuses.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, You’ve done the calculation and expect you’ll need to pay taxes of. Get emails about this page.