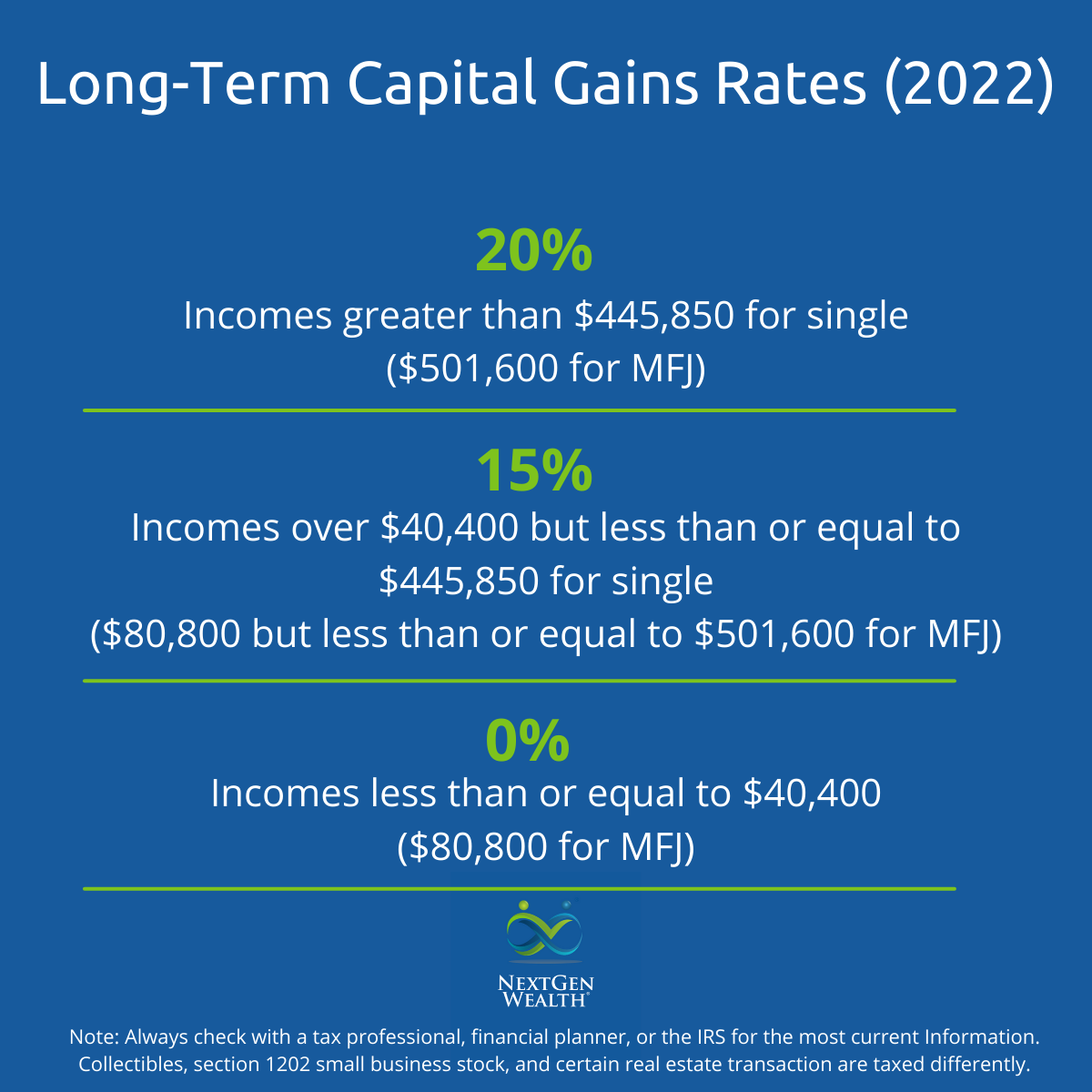

American Funds 2025 Capital Gains. The higher rate of capital gains tax for residential property will reduce from 28% to 24% for disposals completing from 6 april 2025. For 2025, the 15% bracket for capital gains begins at $44,626 of taxable income for single filers.

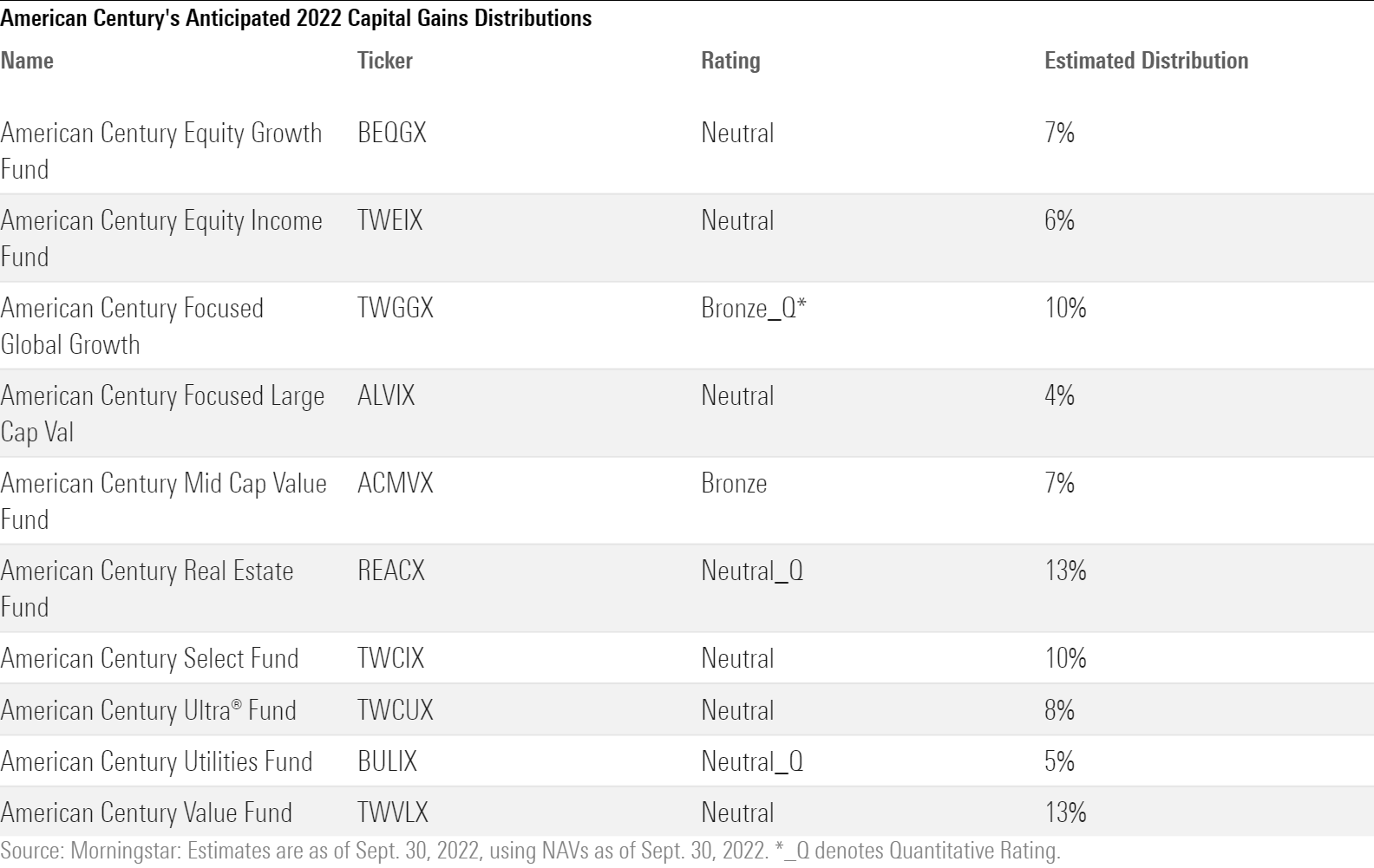

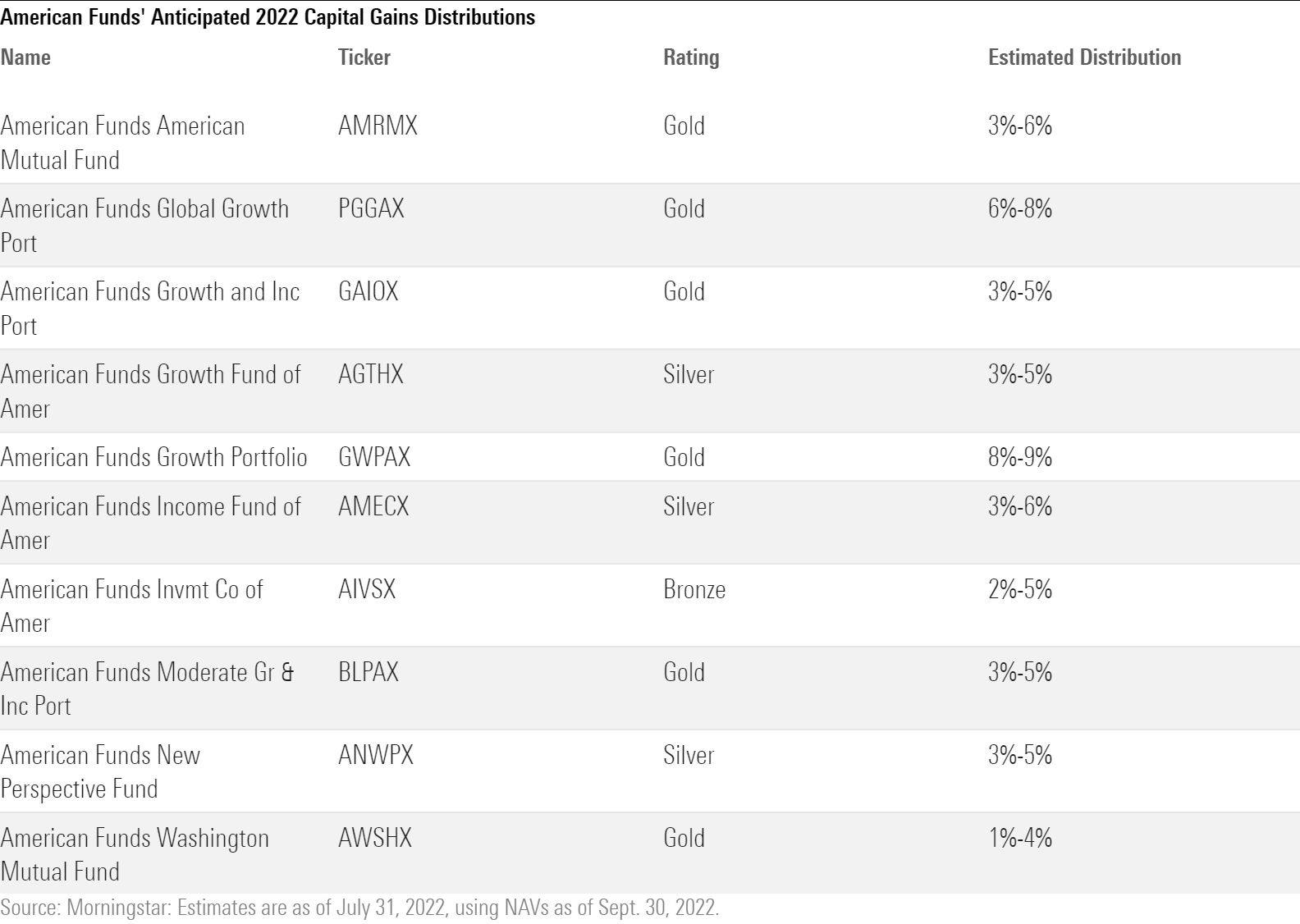

What are the capital gains tax rates for 2025 vs. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

Tranches d'imposition des gains en capital pour 2025 (2025), What are the capital gains tax rates for 2025 vs. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

Capital Gains Tax A Complete Guide On Saving Money For 2025 •, Seeks to help investors pursue longer term goals through exposure to a diverse mix of stocks of companies with strong growth potential. See which funds are paying capital gain distributions, qualified dividends and income dividends classified as a return of capital.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, Capital gains are reported on schedule d, which will be due with your federal tax return (form. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

A Guide to Capital Gains Yield and How It’s Calculated, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how. Dick’s sporting projects capital expenditure of $900 million on a gross basis and $800 million.

Which Popular Funds Will Hit Investors With Losses and Capital Gains, Price at nav $24.11 as of 3/08/2025. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

Which Popular Funds Will Hit Investors With Losses and Capital Gains, It’s that time when fund companies try to give their investors an idea of what their 2025 tax bills. That's up from $44,625 this year.

What Will Capital Gains Tax Be In 2025 2025 BTY, This implies a price to earnings ratio of just around 6. Capital gains are reported on schedule d, which will be due with your federal tax return (form.

Capital Gains Tax Rates for 2025 vs. 2025 Kiplinger, Capital gains for fidelity's equity and bond funds are generally. The table below provides capital gains estimates for funds that have an upcoming distribution scheduled.

Budget 2025 Will longterm capital gains exemption limit go up?, The table below breaks down the. We've got all the 2025 and 2025.

Can Capital Gains Push Me Into a Higher Tax Bracket?, That's up from $44,625 this year. Capital gains are reported on schedule d, which will be due with your federal tax return (form.

To view a fund's historical distributions, select a fund and share class, along with the time period.